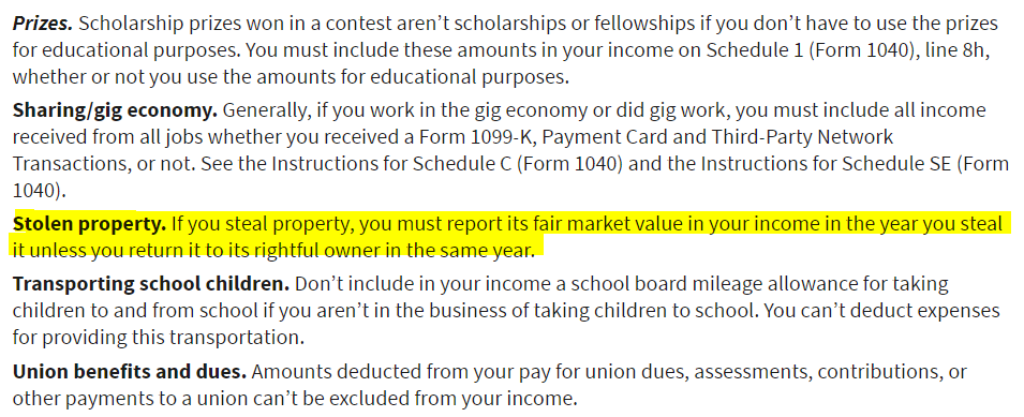

The internet has exploded over the Internal Revenue Service’s 2021 Tax Guide for Individuals, in that they’ve included a section requiring stolen property to be reported on a person’s tax return. Unless, of course, they returned said property the same year, then they’re all good.

There have been many questions floating around asking if the statement is actually real. It is. You can find it yourself on the IRS website under “other income.”

Additionally, the guide states, “Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity.”

It’s unclear if they reporting of illegally obtained funds will offer any protection to the criminal from criminal law if they report the income accurately. As long as Uncle Sam gets his cut, right?

Subscribe today

Objective reporting for the educated American.

This piece was written by Leah Anaya on December 29, 2021. It originally appeared in RedVoiceMedia.com and is used by permission.

The opinions expressed by contributors and/or content partners are their own and do not necessarily reflect the views of the Objectivist. Contact us for guidelines on submitting your own commentary.

Share your opinion

COMMENT POLICY: We have no tolerance for comments containing violence, racism, vulgarity, hard-core profanity, all caps, or discourteous behavior. Thank you for partnering with us to maintain a courteous and useful public environment!